DRS: Draft registration statement submitted by Emerging Growth Company under Securities Act Section 6(e) or by Foreign Private Issuer under Division of Corporation Finance policy

Published on September 10, 2024

As confidentially submitted to the Securities and Exchange Commission on September 10, 2024

Confidential treatment requested by Bowhead Specialty Holdings Inc. pursuant to 17 C.F.R. §200.83.

This draft registration statement has not been filed publicly with the Securities and Exchange Commission, and all information herein remains strictly confidential.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Bowhead Specialty Holdings Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 6331 | 87-1433334 | ||||||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

||||||

452 Fifth Avenue

New York, NY 10018

(212) 970-0269

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

H. Matthew Crusey

General Counsel

Bowhead Specialty Holdings Inc.

452 Fifth Avenue

New York, NY 10018

(212) 970-0269

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Todd E. Freed Dwight S. Yoo Laura Kaufman Belkhayat |

Marc D. Jaffe Erika L. Weinberg Gary D. Boss |

||||

| Skadden, Arps, Slate, Meagher & Flom LLP | Latham & Watkins LLP | ||||

| One Manhattan West | 1271 Avenue of the Americas | ||||

| New York, NY 10001 | New York, NY 10020 | ||||

| (212) 735-3000 | (212) 906-1200 | ||||

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | o | Accelerated filer | o | ||||||||

| Non-accelerated filer | x | Smaller reporting company | o | ||||||||

| Emerging growth company | x | ||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. o

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act, or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Subject to completion, dated , 2024

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities nor a solicitation of an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Shares

Bowhead Specialty Holdings Inc.

Common Stock

The selling stockholders named in this prospectus are offering shares of our common stock. We will not receive any proceeds from the sale of the shares being sold by the selling stockholders.

Our common stock is listed on the New York Stock Exchange (“NYSE”) under the symbol “BOW.” On , 2024, the closing sales price of our common stock as reported on the NYSE was $ per share.

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012 and, as such, have elected to comply with certain reduced public company reporting requirements for this registration statement and may do so in future filings.

We are currently a “controlled company” within the meaning of the corporate governance standards of the NYSE. However, after the completion of this offering, GPC Fund (as defined below) and AFMIC (as defined below), will collectively own approximately % of our outstanding common stock (or % if the underwriters exercise their option to purchase additional shares of common stock in full). Because GPC Fund and AFMIC collectively will beneficially own less than 50% of the total voting power of our common stock after the completion of this offering, we will no longer be a “controlled company” within the meaning of the corporate governance standards of the NYSE after the completion of this offering, and, subject to certain transition periods permitted by the NYSE rules, we will no longer rely on exemptions from corporate governance requirements that are available to controlled companies. See “Management—Loss of Controlled Company Status.”

Investing in our common stock involves risks. See “Risk Factors” beginning on page 17.

Neither the Securities and Exchange Commission nor any state securities commission or regulatory authority has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | ||||||||||

Public offering price |

$ | $ | |||||||||

Underwriting discounts and commissions(1)

|

$ | $ | |||||||||

Proceeds, before expenses, to the selling stockholders |

$ | $ | |||||||||

__________________

(1)See “Underwriting” for additional information regarding underwriting compensation.

Certain of the selling stockholders have granted the underwriters the right, for a period of 30 days from the date of this prospectus, to purchase up to additional shares of common stock at the public offering price less the underwriting discounts and commissions.

The underwriters expect to deliver the shares against payment in New York, New York, on or about , 2024.

| J.P. Morgan | Morgan Stanley |

Keefe, Bruyette & Woods

A Stifel Company

|

||||||||||||

The date of this prospectus is , 2024.

TABLE OF CONTENTS

| Page | |||||

You should rely only on the information contained in this prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. None of we, the selling stockholders or the underwriters have authorized anyone to provide you with different information. None of we, the selling stockholders or any of the underwriters take any responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus, or any free writing prospectus, as the case may be, or any sale of shares of our common stock. Our business, results of operations and financial condition may have changed since such date.

For investors outside the United States: the selling stockholders are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. None of we, the selling stockholders or any of the underwriters has done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of common stock and the distribution of this prospectus outside the United States.

i

ABOUT THIS PROSPECTUS

Industry and Market Data

In this prospectus, we present certain industry and market data. This information is based on third-party sources, data from our internal research and management estimates. Management estimates are derived from publicly available information, our knowledge of our industry and assumptions based on such information and knowledge, which we believe to be reasonable. Such data and management estimates, including any forecasts and projections, have not been verified by any independent source. While we believe this data is generally reliable, such information is inherently uncertain and imprecise. Such information, including assumptions and estimates of our and our industry’s future performance, is subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors” and “Forward-Looking Statements.” These and other factors could cause results to differ materially from the assumptions, estimates and statements made by third parties and by us. You are cautioned not to place undue reliance on such industry and market data.

Trademarks and Service Marks

This prospectus contains references to a number of trademarks and service marks which are our registered trademarks or service marks, or trademarks or service marks for which we have pending applications or common law rights. Trade names, trademarks and service marks of other companies appearing in this prospectus are the property of their respective holders. Solely for convenience, the trademarks, service marks and trade names are referred to in this prospectus without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that we or other owner thereof will not assert, to the fullest extent under applicable law, our or such owner’s rights to these trademarks, service marks and trade names. We do not intend our use or display of other companies’ trademarks, service marks or trade names to imply a relationship with, or endorsement or sponsorship of us by, such other companies.

Non-GAAP Financial Measures

This prospectus contains certain financial measures that are not presented in accordance with generally accepted accounting principles in the United States (“U.S. GAAP”). Under U.S. securities laws, these measures are called “non-GAAP financial measures.” We use these non-GAAP financial measures when planning, monitoring and evaluating our performance. We believe these non-GAAP financial measures give our management and other users of our financial information useful insight into our underlying business performance.

We use the following non-GAAP financial measures throughout this prospectus as defined below:

•Underwriting income is defined as income before income taxes excluding the impact of net investment income, net realized investment gains, other insurance-related income, foreign exchange (gains) losses, non-operating expenses, which include expenses payable by us in connection with this offering, and certain strategic initiatives.

•Adjusted net income is defined as net income excluding the impact of net realized investment gains, foreign exchange (gains) losses, non-operating expenses, which include expenses payable by us in connection with this offering, and certain strategic initiatives.

•Adjusted return on equity is defined as adjusted net income as a percentage of average beginning and ending mezzanine equity and stockholders’ equity.

•Diluted adjusted earnings per share is defined as adjusted net income divided by the weighted average common shares outstanding for the period, reflecting the dilution that may occur if equity based awards are converted into common stock equivalents as calculated using the treasury stock method.

You should not rely on these non-GAAP financial measures as a substitute for any U.S. GAAP financial measure. While we believe that these non-GAAP financial measures are useful in evaluating our business, this information should be considered supplemental in nature and is not meant to be an alternative to our reported results prepared in accordance with U.S. GAAP. In addition, other companies, including companies in our industry, may

ii

calculate such measures differently, which reduces their usefulness as comparative measures. For a reconciliation of such measures to their most directly comparable U.S. GAAP financial measures, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Reconciliation of Non-GAAP Financial Measures.”

Basis of Presentation and Glossary

We have a strategic partnership with AmFam that allows us to leverage AmFam’s legal entities, ratings and licenses through MGA Agreements with the AmFam Issuing Carriers and the Quota Share Agreement. Through the MGA Agreements, BSUI has delegated binding authority and underwrites premiums on behalf of the AmFam Issuing Carriers. Through the Quota Share Agreement, AmFam cedes 100.0% of these premiums to BICI, our wholly-owned insurance company subsidiary, and receives a ceding fee on net premiums assumed. In essence, we originate business on the paper of AmFam through BSUI writing policies issued by AmFam under the name of AmFam and such insurance business that we originate is 100.0% reinsured to BICI, since we do not have the ratings to independently write policies under our own name and on our own paper. See “Prospectus Summary—Our Structure” for additional information. As used herein, unless the context otherwise requires:

•“our policies,” “our insurance contracts” and similar references refer to the policies that we write on AmFam paper that are 100.0% reinsured to BICI;

•“our policyholders” refer to holders of those policies; and

•“we insure” means the reinsurance risk we (through BICI) assume from the AmFam Issuing Carriers.

The following terms are used in this prospectus and have the following meanings unless otherwise noted or indicated by the context:

•“2024 Plan” refers to the Bowhead Specialty Holdings Inc. 2024 Omnibus Incentive Plan.

•“Admitted” refers to insurance issued by an insurer licensed to do business in the state in which the insured exposure is located. Admitted insurance companies are subject to various state laws that govern organization, capitalization, policy forms, rate approvals and claims handling.

•“AFMIC” refers to American Family Mutual Insurance Company, S.I.

•“ALAE” refers to allocated loss adjustment expense.

•“A.M. Best” refers to A.M. Best Company, Inc., a rating agency and publisher for the insurance industry.

•“Amended and Restated Quota Share Agreement” refers to our amended and restated quota share insurance agreement with AFMIC dated as of May 23, 2024.

•“AmFam” refers collectively to AFMIC and its subsidiaries.

•“AmFam Issuing Carriers” refers collectively to Homesite Insurance Company, Homesite Insurance Company of Florida and Midvale Indemnity Company, which are insurance company subsidiaries of AFMIC.

•“BICI” refers to Bowhead Insurance Company, Inc., which is domiciled in Wisconsin and is our wholly-owned subsidiary.

•“BIHL” refers to Bowhead Insurance Holdings LP.

•“BRATs” refers to Bowhead Risk Analysis Tools, our proprietary underwriting tools for the lines in which we write business.

•“BSUI” refers to Bowhead Specialty Underwriters, Inc., which is our wholly-owned subsidiary.

•“BUSI” refers to Bowhead Underwriting Services, Inc., which is our wholly-owned subsidiary.

iii

•“Combined ratio,” expressed as a percentage, is the sum of loss ratio and expense ratio.

•“D&O” refers to Directors and Officers liability insurance, the primary function of which is to protect companies and their directors and officers against monetary damages alleging mismanagement. D&O may be provided on either a primary or excess basis.

•“E&O” refers to Errors and Omissions liability insurance, the primary function of which is to protect companies against negligent acts, errors and omissions of their employees. E&O may be provided on either a primary or excess basis.

•“EPL” refers to Employment Practices Liability insurance, the primary function of which is to protect a company from damages resulting from claims made by employees and/or customers related to the company’s workplace and employment practices (e.g., harassment, discrimination, hostile work environment). EPL may be provided on either a primary or excess basis.

•“Expense ratio,” expressed as a percentage, is the ratio of net acquisition costs and operating expenses to net earned premiums.

•“FI” refers to financial institutions, including banks, insurance companies, investment advisors, alternative asset managers and certain businesses that can provide specialized services to those industries. Coverages provided to FIs may include D&O, EPL, E&O and other liability coverages. Liability insurance may be provided to FIs on either an primary or excess basis.

•“Gallatin Point” refers to Gallatin Point Capital LLC, a private investment firm with a primary focus on making opportunistic investments in financial institutions, services and assets.

•“GL” refers to General Liability insurance which protects a company against liability arising from bodily injury, personal injury or property damage. GL may be provided on either a primary or excess basis.

•“GPC Fund” refers to GPC Partners Investments (SPV III) LP.

•“HCML” refers to Healthcare Management Liability.

•“IBNR” refers to reserves for incurred but not yet reported losses.

•“JOBS Act” refers to the Jumpstart Our Business Startups Act of 2012.

•“LAE” refers to loss adjustment expenses.

•“Loss ratio,” expressed as a percentage, is the ratio of net losses and loss adjustment expenses to net earned premiums.

•“MGA” refers to managing general agent, a business which has authority from an insurance company to underwrite risks, bind policies and settle claims on behalf of the insurance company.

•“MGA Agreements” refers to our Managing General Agency Agreements with the AmFam Issuing Carriers.

•“MMF” refers to Miscellaneous Medical Facilities.

•“MPL” refers to Miscellaneous Professional Liability.

•“NAIC” refers to the National Association of Insurance Commissioners.

•“Non-admitted” or excess and surplus (“E&S”) lines refers to policies generally not subject to regulations governing premium rates or policy language. We also consider insurance written on an admitted basis through either the New York Free Trade Zone or similar commercial deregulation exemptions available in certain jurisdictions, and as a result free of rate and form restrictions, to be E&S business.

iv

•“Original Quota Share Agreement” refers to our quota share reinsurance agreement with AFMIC, which has been effective since November 1, 2020.

•“P&C” refers to Property and Casualty insurance.

•“PL/GL” refers to Professional and General Liability insurance.

•“Quota Share Agreement” refers to refers to the Original Quota Share Agreement and the Amended and Restated Quota Share Agreement.

•“Return on equity” is net income as a percentage of average beginning and ending mezzanine equity and stockholders’ equity.

•“SAP” refers to the Statutory Accounting Principles established by the NAIC.

•“Sarbanes-Oxley Act” refers to the Sarbanes-Oxley Act of 2002.

•“SEC” refers to the Securities and Exchange Commission.

•“U.S. GAAP” refers to the generally accepted accounting principles in the United States.

•“Wisconsin OCI” refers to the Office of the Commissioner of Insurance of Wisconsin.

v

PROSPECTUS SUMMARY

This summary highlights selected information appearing elsewhere in this prospectus. This summary is not complete and does not contain all of the information that you should consider before investing in our common stock. You should carefully read the entire prospectus, including the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes included elsewhere in this prospectus.

All references to the “Company,” “Bowhead,” “we,” “our” and “us,” unless the context otherwise requires, are to Bowhead Specialty Holdings Inc., a Delaware corporation, and its consolidated subsidiaries and all references to the “Issuer” are only to Bowhead Specialty Holdings Inc.

Bowhead Specialty Holdings Inc.

Who We Are

We are a profitable and growing company providing specialty P&C products. We were founded by industry veteran Stephen Sills and are led by a highly experienced and respected underwriting team with decades of individual, successful underwriting experience. We focus on providing “craft” solutions in our specialty lines and classes of business that we believe require deep underwriting and claims expertise in order to produce attractive financial results. We have initially focused on underwriting Casualty, Professional Liability and Healthcare Liability risks where our management team has deep experience. Across our underwriting divisions, our policyholders vary in size, industry and complexity and require specialized, innovative and customized solutions where we individually underwrite and structure policies for each account. As a result, our products are primarily written on an E&S basis, where we have flexibility of rate and policy form. Our underwriting teams collaborate across our claims, actuarial and legal departments, ensuring they are aware of developments that could impact our business and using a consistent approach to our underwriting. We handle our claims in-house; our claims management teams, which align with our three underwriting divisions, have significant experience in the markets on which we focus and work closely with our underwriting and actuarial teams, keeping them informed of claims trends, providing feedback on emerging areas of loss experience and identifying and addressing key issues and adjusting loss reserves as appropriate. We distribute our products through carefully selected relationships with leading distribution partners in both the wholesale and retail markets. We pride ourselves on the quality and experience of our people, who are committed to exceeding our partners’ expectations through excellent service and expertise. Our collaborative culture spans all functions of our business and allows us to provide a consistent, positive experience for all of our partners. This consistency of experience, combined with our client-focused approach, has created a company with which our distribution partners want to work, supporting the continued growth of our platform.

Our principal objective is to create and sustain superior returns for our stockholders by generating consistent underwriting profits across our product lines and through all market cycles, while prudently managing capital. We have grown substantially over the past two years, generating gross written premiums of $356.9 million for the year ended December 31, 2022 and $507.7 million for the year ended December 31, 2023, a year-over-year increase of 42.2%. For the year ended December 31, 2023, we delivered a combined ratio of 95.0%, net income of $25.0 million and a return on equity of 18.2%. We have generated gross written premiums of $212.4 million for the six months ended June 30, 2023 and $314.0 million for the six months ended June 30, 2024, a year-over-year increase of 47.8%. For the six months ended June 30, 2024, we delivered a combined ratio of 98.7%, net income of $12.5 million and a return on equity (annualized) of 9.4%. We believe that our current market opportunity, differentiated expertise, relationships, culture and leadership team position us well to continue to grow our business profitably.

BICI is domiciled and licensed as an admitted insurer in the state of Wisconsin. BSUI is a licensed business entity producer, domiciled as an insurance producer and an MGA in the state of Texas, and a licensed agency in all 50 states, Washington D.C. and Puerto Rico. BSUI does business as “Bowhead Specialty Insurance Services” in California, Illinois, Nevada, New York, Utah and Virginia. Our ability to write business, however, is currently largely based on our relationship with AmFam. Through our relationship with AmFam, we are able to write business on an admitted basis in all 50 states and Washington D.C. and on a non-admitted basis in all 50 states, Washington D.C. and Puerto Rico. For the six months ended June 30, 2024, there were four states in which 5.0% or more of our

1

gross written premiums were concentrated: California (15.9%), Florida (14.9%), Texas (11.2%), and New York (7.4%).

We founded our business in September 2020, recognizing a favorable pricing environment and a growing and unmet demand from brokers and policyholders for craft solutions and quality service in complex lines of business. We built a nimble, remote-friendly organization able to attract best-in-class talent that we source nationwide to service this demand, with over 220 employees as of June 30, 2024 across the country who are committed to operational excellence and superior service. We are backed by capital provided by GPC Fund and our strategic partner, AmFam, a mutual insurer with an “A” (Excellent) financial strength rating from A.M. Best as of June 30, 2024 and approximately $7.0 billion of policyholder surplus as of December 31, 2023. We originate business on the paper of AmFam through BSUI writing policies issued by AmFam under the name of AmFam and reinsure 100.0% of the insurance business we originate to BICI, our wholly-owned insurance company subsidiary. Our partnership with AmFam has enabled us to grow quickly but prudently, deploying capital and adding employees when business and growth justified.

Our Business

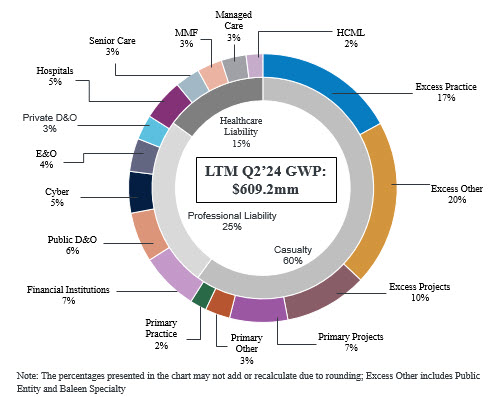

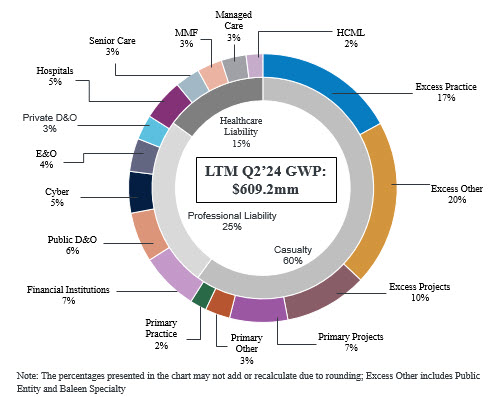

We currently offer craft solutions to a wide variety of businesses across three underwriting divisions: Casualty, Professional Liability and Healthcare Liability. The below chart reflects our gross written premiums by underwriting division and product for the twelve months ended June 30, 2024:

We take a highly collaborative and customized approach to underwriting. Our fully integrated and accountable underwriting methodology brings the specialized industry knowledge, business acumen and strong distribution relationships that we believe are required to profitably underwrite the complex lines of business on which we focus. Our underwriting teams all have deep underwriting and industry experience in the lines of business we write. We aim to offer craft solutions to our clients in a timely and consistent manner. We underwrite, structure and price quotes on a case-by-case basis while maintaining disciplined risk parameters including strict policy limits. We have developed and constantly evaluate our risk framework with significant input from our actuarial, claims, legal and finance functions. Similarly, we frequently hold “roundtable” discussions, which are a key part of our underwriting

2

process, and depending on the risk, can occur at multiple levels across the company, often involving functions outside of underwriting teams, including actuarial, claims, legal and finance. Roundtables allow our underwriters to leverage appropriate expertise across the organization; our culture of collaboration and accountability means that underwriting decisions are not made in isolation, allowing us to deliver consistent underwriting decisions with input from multiple perspectives.

Casualty: Our Casualty division provides tailored solutions on a primary and excess basis through a wholesale-only distribution channel and consists of a team of experienced underwriters with nationwide capabilities who excel at handling complex risks. We specialize in GL coverage for risks in the construction, distribution, heavy manufacturing, real estate and hospitality segments and also consider underwriting risks in a broader range of industries. Within these industries, we seek to identify specific segments that play to our strengths and in which we believe we can generate profitable growth. For example, within construction, a $2.4 trillion industry in the U.S. as of December 31, 2023 according to the Bureau of Economic Analysis, we seek to participate in large, complex and engineered construction projects.

| Product | Description | Distribution | |||||||||||||||

| Excess Projects |

•Offers excess coverage to large commercial general contractors or developers on single commercial, residential and infrastructure projects

|

•E&S products distributed by wholesale brokers

|

|||||||||||||||

| Excess Practice |

•Offers annually renewable excess coverage for GL, Product Liability and Auto Liability to middle market contractors (typically from $100 million to $1 billion in revenue) nationally

|

•E&S products distributed by wholesale brokers

|

|||||||||||||||

| Excess Other |

•Offers annually renewable first excess, or higher excess, coverage to real estate, hospitality, public entity or manufacturing companies

|

•Primarily E&S products distributed by wholesale brokers

|

|||||||||||||||

| Primary Projects |

•Offers wrap-up GL coverage to large general contractors and developers on single commercial and residential projects

|

•E&S products distributed by wholesale brokers

|

|||||||||||||||

| Primary Practice |

•Offers annually renewable GL coverage to middle market (under $100 million in revenue) general contractors and subcontractors

|

•E&S products distributed by wholesale brokers

|

|||||||||||||||

| Primary Other |

•Offers GL coverage to middle market (under $200 million in revenue) commercial and industrial manufacturers and distributors

|

•E&S products distributed by wholesale brokers

|

|||||||||||||||

3

Professional Liability: Our Professional Liability division provides underwriting solutions on both an admitted and E&S basis for standard and nonstandard risks and writes for a broad variety of entities, including publicly traded and privately held FIs as well as not-for-profit organizations. We distribute this business through wholesale and retail channels. The Professional Liability market, in general, is highly competitive; however, we believe that there are specific sub-markets, including in FI, private D&O and E&O, that have attractive growth and return potential. Additionally, we selectively pursue exposures in small and middle market public D&O where we believe pricing remains favorable and view Cyber and Technology E&O as a significant growth opportunity where we are developing primary capabilities to target smaller accounts that we believe are experiencing less rate pressure compared with larger accounts.

| Product | Description | Distribution | |||||||||||||||

| FI |

•Offers suite of management liability products including D&O, E&O, EPL, Fiduciary, Fidelity and related lines to asset and investment management companies, banks and lenders, insurance companies and emerging FI companies including specialty niches

•Also offers primary coverage for specific FI segments, including investment management, on a manuscript basis

|

•Primarily admitted products mostly distributed by retail agents

|

|||||||||||||||

| Public D&O |

•Offers primary and excess coverage to public companies of all sizes in a wide variety of sectors

•Also offers Excess Fiduciary and EPL coverage

|

•Primarily admitted products mostly distributed by retail agents

|

|||||||||||||||

| Private D&O |

•Offers D&O, EPL, Fiduciary and Crime coverage in a package policy with separate or shared limits to private and not-for-profit entities

|

•Primarily admitted products mostly distributed by retail agents

|

|||||||||||||||

E&O (includes MPL and Lawyers) |

•Offers Primary and Excess Miscellaneous E&O coverage to approximately 40 classes of businesses, including property managers, developers and construction management, associations, franchisors and consultants

•Also offers Excess Lawyers Professional Liability coverage to law firms up to 100 attorneys

|

•Primarily E&S products, mostly distributed by wholesale brokers

|

|||||||||||||||

| Cyber |

•Offers Excess follow-form Cyber and Technology E&O Liability coverage to middle market and large corporate organizations

|

•E&S products mostly distributed by retail agents

|

|||||||||||||||

4

Healthcare Liability: Focusing exclusively on healthcare entities, our Healthcare Liability division provides tailored solutions for nonstandard risks faced by healthcare organizations on both a primary and excess basis. We offer PL/GL, as well as Management Liability, across four major healthcare segments—hospitals, senior care providers, managed care organizations and miscellaneous medical facilities—through select wholesale and retail channels. Within Healthcare Liability, we have seen rate increases for several years starting initially with Senior Care followed by Managed Care and more recently in the Hospitals segment. We believe these rate increases were the result of carriers restricting their underwriting appetite following increases in both the frequency and severity of claims caused both by inadequate pricing and outsized settlements and jury verdicts (sometimes referred to as “social inflation”). We aim to expand our Healthcare Liability business meaningfully with sophisticated hospital buyers for which we believe we have differentiated underwriting expertise and claims handling capabilities, with large senior care facilities in a segment that continues to grow alongside population demographics, in the specialized Managed Care E&O marketplace where we believe we have limited competition and in other specialized markets within the healthcare sector where we anticipate profitable growth opportunities.

| Product | Description | Distribution | |||||||||||||||

| Hospitals |

•Offers excess Healthcare PL/GL coverage to hospitals on an insurance or facultative reinsurance basis

|

•E&S products distributed mostly by retail brokers

|

|||||||||||||||

| Senior Care |

•Offers Healthcare PL/GL coverage to skilled care, assisted living, independent living and continuing care retirement community facilities

•Considers traditional structures as well as alternative solutions

|

•E&S products distributed by wholesale and retail brokers

|

|||||||||||||||

| Managed Care |

•Offers Managed Care E&O coverage to various classes of managed care providers and payors

|

•E&S products distributed by wholesale and retail brokers

|

|||||||||||||||

MMF |

•Offers Healthcare PL/GL coverage to outpatient medical facilities

•Considers traditional structures as well as alternative solutions

|

•E&S products mostly distributed by wholesale and retail brokers

|

|||||||||||||||

HCML |

•Offers primary and excess D&O, EPL, Fiduciary and Crime coverage to all classes listed above, including through a package policy with separate or shared limits

|

•Primarily admitted products distributed by wholesale and retail brokers

|

|||||||||||||||

Although the products we underwrite do not directly cover physical damage, we offer liability coverage which may include liability resulting from physical damage. For example, we may provide a policy insuring a builder of a building and if a building built by the builder collapses, our policy may cover losses if the builder’s acts or omissions caused the collapse of the building, which could include liability for physical damages to individuals resulting from the collapse of the building or costs of repairs or rebuilding. However, we do not currently offer property coverage and thus do not currently provide coverage for direct physical damage. We offer small limits as part of our Senior Care business in the event a senior care facility must be shut down due to certain events which could include physical damage to the senior care facility.

5

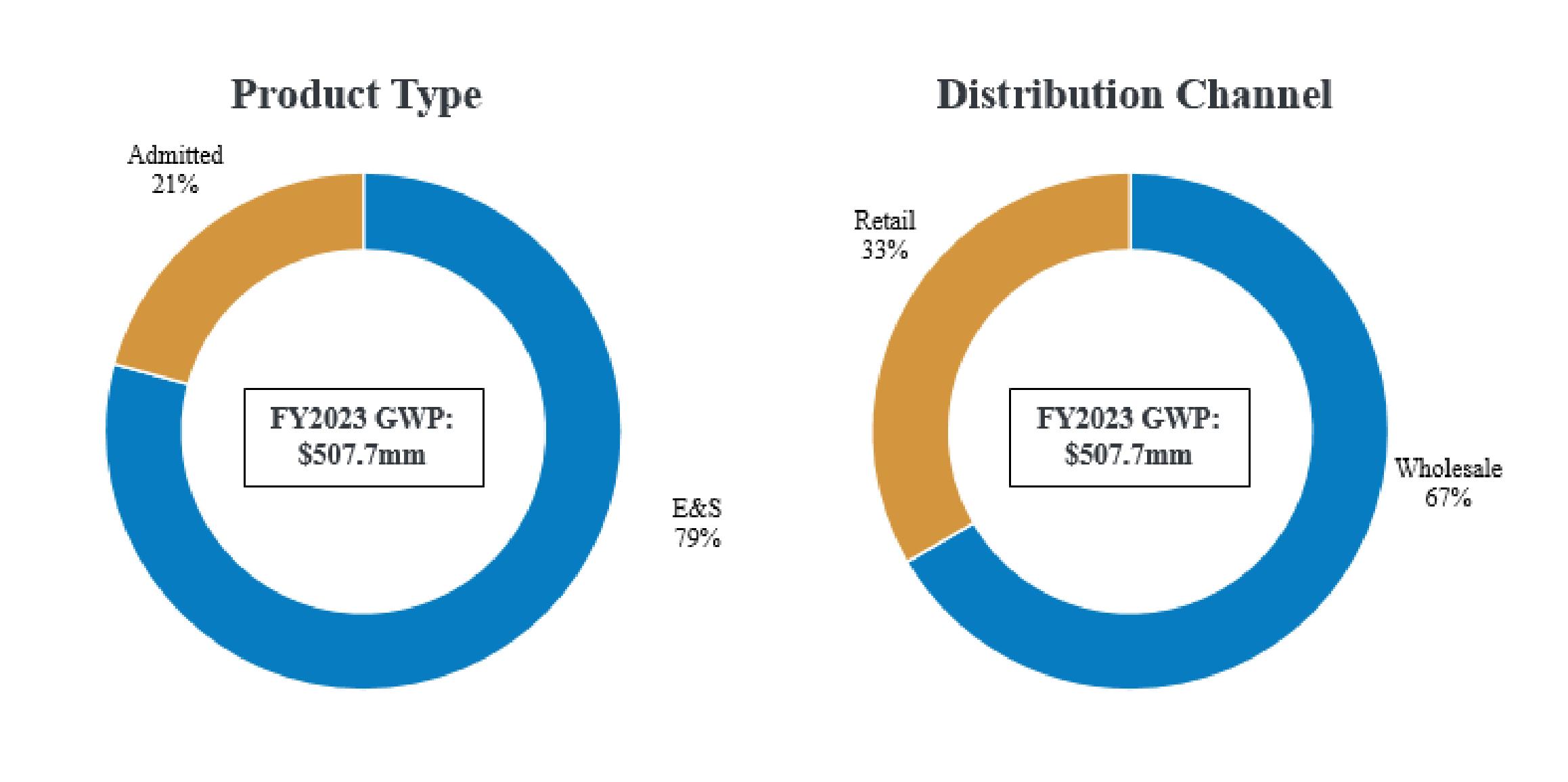

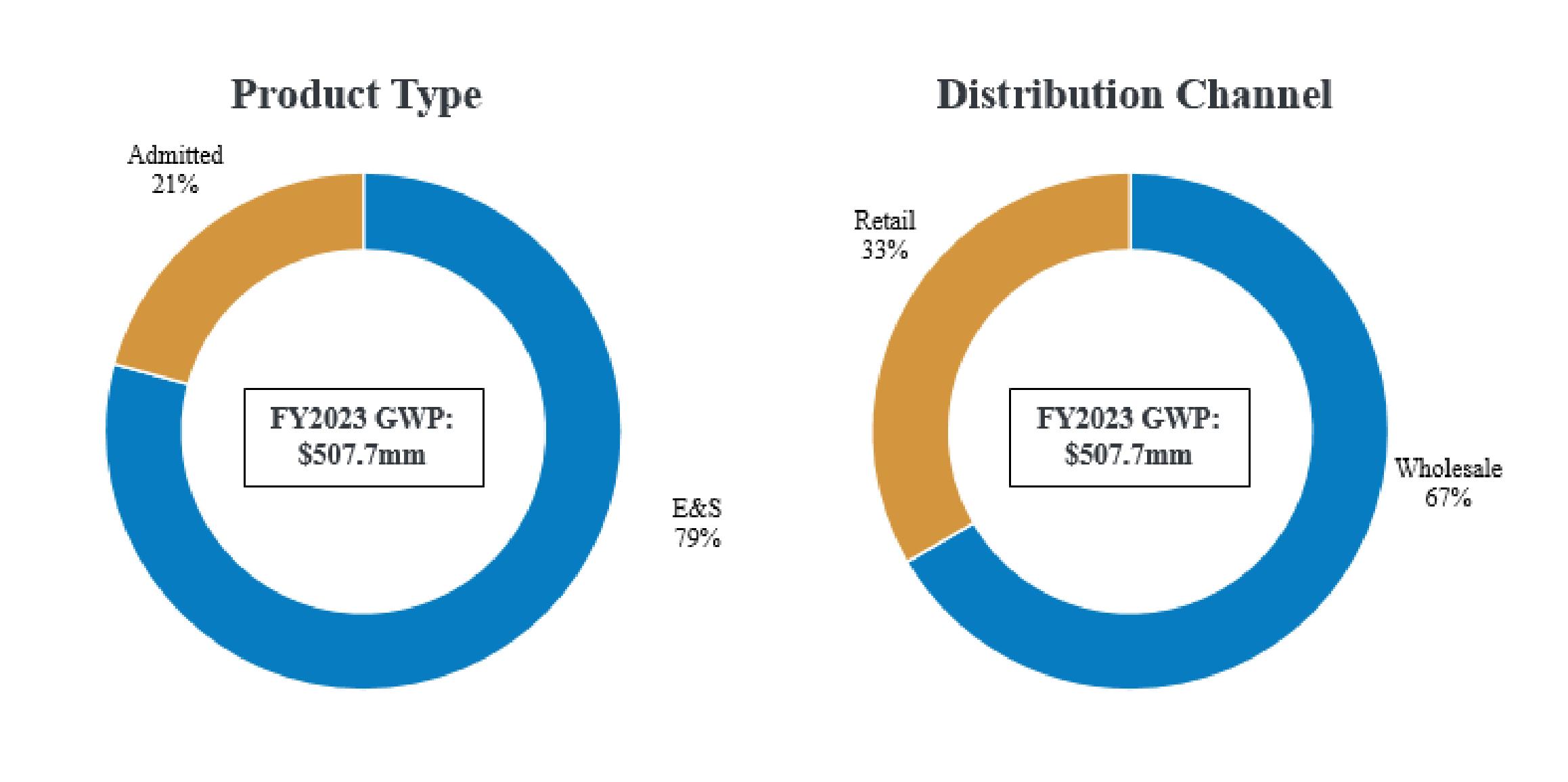

The below chart reflects our gross written premiums by product type and distribution channel for the year ended December 31, 2023:

Because our clients often require highly customized solutions not available in the admitted market, our business is primarily written on an E&S basis. This approach allows us to maximize our policy flexibility and meet our policyholders’ unique needs all while delivering the differentiated level of service and execution for which we have developed a reputation.

We see an opportunity to underwrite an attractive range of risks in a sustainable and profitable manner and seek to employ underwriters with the technical expertise to structure terms and conditions and prudently manage risks across such lines of business. We execute this approach through thoughtful and careful risk selection and limit deployment while seeking to optimize our results. We aim to take advantage of a market that continues to grow as businesses and risks continue to evolve. We believe that our remote-friendly platform enables us to scale our capabilities nimbly within lines of business that we feel align with our expertise, goals and risk appetite. We believe that this approach is a key differentiator in positioning us to grow profitably across market cycles in each of our core competencies.

We are able to deliver mutually beneficial and bespoke solutions thanks to the deep, longstanding wholesale and retail distribution relationships that our underwriters have established. We go to market under the Bowhead brand, leveraging the strong reputation that we have quickly established within the broker community. We distribute our products through a network of wholesale and retail broker organizations utilizing different channels and relationships across our three underwriting divisions. In Casualty, we focus on partnering with wholesale distributors, whereas in Professional Liability and Healthcare Liability, we work with a combination of wholesale and retail partners. We source our broker relationships based on quality of business and reputation and alignment of long-term objectives. We strive to maintain a core group of brokers that consider us to be their “first call.” We take a deliberate approach to building our broker network and actively evaluate new and existing broker relationships based on the opportunities we see and choose to pursue in the market.

We handle our claims in-house, which we believe to be a key competitive differentiator. Aligning with our underwriting focus on specific product lines, our claims management teams are highly specialized to ensure that they can apply their expertise in handling claims to each market we serve. As part of our collaborative approach, our claims teams frequently participate in underwriting discussions, both internally and with our distribution partners and policyholders. We believe maintaining full control of the claims-handling process allows us to meet our rigorous quality standards and manage our losses and LAE effectively, and ultimately leads to more profitable underwriting.

6

We have a remote-friendly operating model with most employees working remotely supplemented by targeted, in-person collaboration. We formed our company during COVID-19 mandated lockdowns, which initially required us to be 100% remote. Our management team built our company’s operating platform and developed its culture from the beginning to function nimbly in a hybrid environment. This approach has enabled us to recruit talented employees nationwide without regard for Bowhead-specific office locations. We use frequent video calls to collaborate throughout the day and hold a weekly company-wide call to align on short- and long-term goals. We encourage employees near our New York City and Chicago offices to work in the office on Wednesdays and use off-site meetings and conferences to get broader groups of employees together in person throughout the year. We believe our hybrid operating model is a competitive advantage in terms of attracting talent and maintaining our collaborative culture. Unlike other insurance companies that are trying to bring employees back to the office or learning to operate in a hybrid environment, our remote-friendly operating model is an innate part of our culture and a meaningful contributor to our success.

Our nimble business model enables us to leverage technology, data and analytics efficiently throughout each stage of the underwriting process. Our modern, cloud-based technology platform enables us to leverage technology that we have created in-house and by using leading third-party solutions. We have developed proprietary underwriting tools, BRATs, for the lines in which we write business, and which are further supplemented with customized third-party data. Our technology investments focus on development and integration of data, while our technology tools allow us to understand the underlying risks for each line of business, enabling us to provide rapid feedback to brokers on structure and price.

We believe in the profitability of the business we write, and consequently look to retain as much of that premium as possible while maintaining strict risk limits. We strategically purchase reinsurance through pro rata and excess of loss reinsurance agreements on a treaty or facultative basis with a goal of protecting our capital and minimizing volatility in our earnings from severity events. We focus on a diversified panel of high-quality reinsurance partners. As of June 30, 2024, 100.0% of our reinsurance recoverables were derived from reinsurers with an “A” (Excellent) financial strength rating from A.M. Best, or better.

Our Competitive Strengths

We believe that our competitive strengths include:

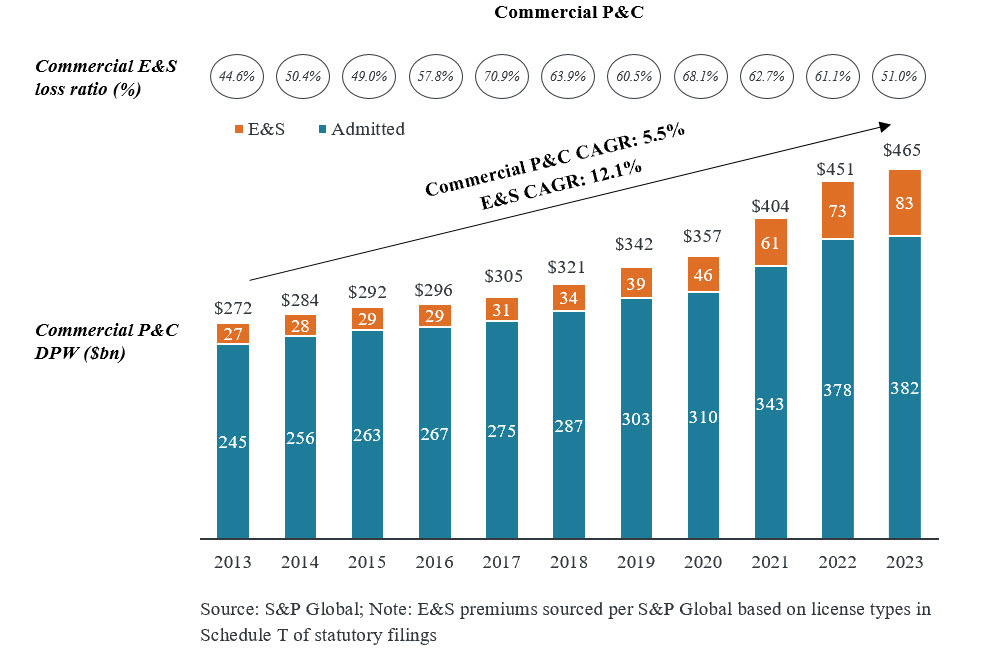

Focus on targeted, specialty P&C market segments with profitable growth opportunities. We primarily operate in the $83.3 billion U.S. commercial E&S market (for the year ended December 31, 2023) that has grown 20.9% annually since 2019. We carefully selected specific segments of this market, only entering markets in which we can profitably grow by leveraging our significant underwriting expertise or by acquiring talent with proven track records of generating underwriting profits. Our target markets have experienced meaningful dislocations and have outperformed the broader U.S. commercial E&S market in loss ratio by four points annually on average over the same five-year period. We believe that we have positioned ourselves as a leader within our sectors and believe our specialized, innovative and customized underwriting approach combined with our strong broker relationships will provide us with an enduring competitive advantage.

Disciplined approach to underwriting led by highly experienced teams with specialized expertise. Our underwriting team is led by industry veterans, who have each served as senior insurance executives, with more than 17 decades of combined industry experience. They bring specialized industry knowledge, strong distribution relationships and long track records of profitably underwriting the lines of business in which we specialize. We underwrite each risk individually, within prudently managed risk limits, to meet the unique demands of our policyholders. We focus on delivering accurate pricing, speed of execution and consistency to our clients across market cycles.

Fully integrated and accountable underwriting value chain. We maintain strict control across our underwriting value chain that is managed in-house and fully integrated across origination, structuring, data and analytics, actuarial, claims and legal. These functional teams are not siloed, but rather work in close coordination with our underwriters in order to provide flexible solutions to our customers quickly and profitably. Our organization is singularly focused on underwriting results.

7

Deep, long-term distribution relationships based on expertise, service and mutual benefit. Our management team and underwriters have built meaningful long-term relationships with the leading distributors in their respective lines and classes of business. We are selective in choosing our distribution partners and look for those that have technical expertise in our chosen lines and a shared commitment to excellent service. Further, we seek out situations where we have the ability to write a significant portion of a distribution partner’s business. We provide our brokers timely responses and feedback to submissions and mobilize resources across the organization to get the right deals done. As a result, we consistently receive high-quality business from our broker network. We believe our existing broker relationships and our approach to maintaining these relationships are key components to our long-term growth and success.

Highly collaborative and execution-oriented culture that spans across all functions working toward a common goal of underwriting profitability. Across our company, we collaborate at all levels and operational functions. We frequently hold roundtable discussions whereby key members of our team provide insights and perspectives to allow us to assess emerging opportunities quickly and holistically, all while establishing a common culture of excellence. We leverage technology and our flat organizational structure to mobilize our resources across the organization to execute on opportunities promptly.

Nimble and efficient platform with hybrid operating model and modern technology. We built our operating platform using the latest available technology on a remote-friendly basis. We believe our current hybrid operating model provides us with a significant competitive advantage to attract and retain the best industry talent from across the country to our organization and to deploy them locally to meet our clients’ unique needs. Our cloud-based modern technology systems allow us to run day-to-day operations efficiently and integrate new tools seamlessly. We developed our pricing and analytics tools purposefully in-house and we strategically leverage third-party technology partnerships where we deem them to be more efficient. We have none of the typical legacy systems issues that impact many of our competitors.

Strong balance sheet with a conservative investment portfolio and no reserves from accident years prior to 2020. We believe our strong balance sheet is a key advantage that enables us to grow our business while delivering strong financial performance. We maintain a conservative investment portfolio concentrated in liquid and highly rated fixed income securities. We entered the market toward the end of 2020 when insurance rates were starting to increase following multiple years of rate inadequacy. Since then, we have continued to experience a favorable pricing environment, while many of our competitors are dealing with the potential for adverse developments. We have built a robust reserving process and regularly review our estimates in consultation with independent advisors to benchmark against industry experience.

Experienced and entrepreneurial leadership team. We have assembled what we believe is a best-in-class team of leaders from across the P&C industry. Our team is comprised of highly experienced executives who have previously held leadership roles across underwriting, claims, actuarial, technology, legal and operations at leading insurance companies. We are led by our founder and Chief Executive Officer, Stephen Sills, who has over four decades of experience launching and leading businesses in the specialty P&C industry. Prior to Bowhead, Stephen founded two specialty insurance businesses that went public: Darwin Professional Underwriters Inc. (“Darwin”) and Executive Risk Inc. (“Executive Risk”). As the founder and Chief Executive Officer of those organizations, Stephen was responsible for achieving annualized stock price appreciation between their initial public offerings and sales to larger companies of 38.8% and 44.1%, respectively, as compared to 0.5% and 22.1% annualized returns of the S&P 500 during those same periods. Our Chief Underwriting Officer, David Newman, has over four decades of experience, including serving as Chief Underwriting Officer at Darwin, where he worked closely with Stephen Sills, and as the Chief Underwriting Officer at Allied World Assurance Company Holdings, Ltd (“Allied World”) in the North America and Global Markets division, following the acquisition of Darwin. Our leadership team, including Stephen, David and each of our three underwriting leads, has an average of more than 30 years of experience in their respective areas of expertise. In addition, our board of directors includes accomplished industry practitioners who bring decades of invaluable experience from prior roles at insurance and financial services companies.

8

Our Strategy

We believe that our approach to our business will allow us to achieve our goals of both growing our business and generating attractive returns for our stockholders. Our strategy involves:

Attract and retain best-in-class talent across the business. Our long-term success as an organization relies on hiring and retaining the right people to help us grow our business profitably. We seek to hire talented professionals nationwide with strong industry experience and technical expertise across our organization to help drive underwriting performance and operational efficiencies. We believe that our hybrid operating model and entrepreneurial, collaborative, execution-driven and customer-first culture have made us a company of choice for the best talent in the industry.

Profitably grow our existing lines of business. We are focused on generating an underwriting profit while growing our existing book of business sustainably. In 2023, our third full year of operations, we generated a 63.0% loss ratio and 95.0% combined ratio, while achieving a 42.2% year-over-year growth in gross written premiums. Our business lines are highly specialized and require deep industry knowledge and strong execution capabilities. As a result, we believe we are able to generate underwriting profitability by identifying market dislocations early and executing on these opportunities quickly. As the demand for specialized insurance solutions continues to rise, we expect to continue capitalizing on the broader market opportunity and expanding our market share to generate strong underwriting results.

Opportunistically and strategically expand into new products and markets. We actively evaluate new lines of business for capital deployment based on our established capabilities in the specialty P&C market. We believe we can leverage our distribution relationships and expertise in Casualty, Professional Liability and Healthcare Liability to expand into adjacent lines and classes that share a similar underwriting framework. We also believe there is an attractive opportunity in the small and micro commercial lines segment, where we can generate new and profitable growth opportunities by leveraging our existing expertise and distribution relationships. We constantly monitor the broader market to evaluate opportunities to expand organically where we believe there is a match between our broader capabilities and our perception of attractive underlying market conditions and needs.

We are focused on generating long-term value for our stockholders, including through expanding into new products and markets. As part of this effort, in the second quarter of 2024 we launched a new E&S division focused on small, niche, hard-to-place risks. We call this division “Baleen Specialty”, a streamlined, low touch “flow” underwriting operation that supplements the “craft” solutions divisions that we offer today. We write this business on a 100% non-admitted basis and our initial product is contractors’ general liability. We expect to have high submission volumes relative to the policies we will bind and have developed a tech-enabled process with low touch processing. We believe that we are able to rapidly and accurately underwrite, quote and bind policies, allowing us to provide quick and accurate feedback to our wholesale broker partners. We will maintain full underwriting authority and manage all of the claims in-house. We believe there is an attractive opportunity to underwrite profitable business within this market segment, and we believe our underwriting expertise and built for purpose technology platform will allow us to grow quickly and generate strong underwriting profitability.

Maintain our underwriting-first culture across market cycles. We strive to deliver consistent and strong underwriting results in all market cycles. We take a methodical approach to building our lines of business and our distribution network. We do not chase pricing trends; we aim to get ahead of them by identifying leading indicators at the micro level, forming our own view of risks and executing promptly when opportunities arise. We will only pursue lines of business that align with our expertise and expected underwriting profitability. We have developed tools and resources to enable quick and accurate decision-making and to monitor alignment between our underwriting framework and bottom-line results. We believe our continuous focus on underwriting excellence will allow us to generate profitable growth through all market cycles.

Leverage expertise, technology, data and analytics to drive underwriting performance. As we have established our platform, we have made significant investments in technology and will continue to do so to support our growth and operational efficiency. We leverage our BRATs to drive efficiency, accuracy and speed in our underwriting process. BRATs allow underwriters to streamline underwriting workflows and make pricing decisions

9

that are based on a consistent view of risk informed by our own loss experience and broader industry level developments. We continue to introduce and integrate new tools into our internal system to allow our underwriters to process quotes more efficiently and perform day-to-day tasks in seamless coordination with other functions. Our goal as an organization is to build a technology stack that frees up our underwriters from performing highly repetitive, uniform tasks and allows them to apply judgment, creativity and critical thinking to form solutions that can be executed quickly. Our focus on developing technology, data and analytics to drive efficiency is central to our “underwriting-first” strategy.

Deliver attractive returns on capital to our stockholders. We intend to deliver attractive underwriting results, overall profitability and returns to our stockholders through underwriting expertise and disciplined risk management, supported by a conservative investment strategy, legacy free reserves and prudent approach to capital deployment. We aim to take advantage of our strong balance sheet to deploy capital prudently and profitably across market cycles. We believe that current market conditions present an attractive opportunity for growth and our underwriting-first approach will allow us to generate profitable and sustainable underwriting results over the long term.

Recent Developments

On May 28, 2024, we completed our initial public offering, of 7,529,412 shares of common stock, at the public offering price of $17.00 per share. The underwriters exercised their option to purchase 1,129,411 additional shares of common stock from the Company. The net proceeds to the Company were approximately $132.0 million, after deducting underwriting discounts and commissions and offering expenses payable by the Company.

Our Structure

We conduct our operations through BICI, an insurance company licensed and domiciled in the state of Wisconsin, BSUI, an MGA, and BUSI.

AFMIC, which owns approximately 18.6% of our common stock, as of , 2024, is also our strategic partner. We leverage AmFam’s legal entities, ratings and licenses through MGA Agreements with AmFam insurance company subsidiaries, Homesite Insurance Company, Homesite Insurance Company of Florida and Midvale Indemnity Company, and the Quota Share Agreement. Through the MGA Agreements, BSUI has delegated binding authority and underwrites premiums on behalf of the AmFam Issuing Carriers. Through the Quota Share Agreement, as of June 30, 2024, AmFam cedes 100.0% of this premium to BICI and receives a ceding fee of 2.0% on net premiums assumed. In essence, we originate business on the paper of AmFam through BSUI writing policies issued by AmFam under the name of AmFam and reinsure 100.0% of the insurance business we originate to BICI, since we do not currently have the ratings to write policies under our own name and on our own paper. AmFam also participates in our outward reinsurance program having negotiated terms in the same manner as our other reinsurance partners. Through these agreements, we also provide underwriting and claims handling services from BSUI to the AmFam Issuing Carriers. For more information see “Certain Relationships and Related Party Transactions—Arrangements With AmFam and its Affiliates” for additional information on the MGA Agreements and the Quota Share Agreement.

AmFam is the nation’s 12th largest P&C group by premiums with policyholder surplus of approximately $7.0 billion as of December 31, 2023. AmFam has an “A” (Excellent) financial strength rating from A.M. Best, a financial size category XV and also maintains an S&P rating of “A-” and a Moody’s rating of “A2”, both as of June 30, 2024.

Our partnership with AmFam has enabled us to grow quickly but prudently, deploying capital on an efficient basis and adding employees when business and growth justified. This approach has allowed Bowhead to add team members deliberately, helping to ensure that we maintain our collaborative culture.

Summary of Risk Factors

Investing in our common stock involves a high degree of risk. You should carefully consider all of the risks described in “Risk Factors” before deciding to invest in our common stock. If any of the risks actually occur, our business, results of operations, prospects and financial condition may be materially adversely affected. In such case,

10

the trading price of our common stock may decline and you may lose part or all of your investment. Below is a summary of some of the principal risks we face:

•our financial condition and results of operation could be materially adversely affected if we do not accurately assess our underwriting risk;

•competition for business in our industry, including from specialty insurance companies, standard insurance companies and MGAs, is intense;

•inability to maintain our strategic relationship with AmFam would materially adversely affect our business;

•a decline in AmFam’s financial strength rating or financial size category may adversely affect our financial condition and results of operations;

•because our business depends on insurance retail agents, brokers and wholesalers, we are exposed to certain risks arising out of our reliance on these distribution channels that could adversely affect our results;

•we rely on a select group of brokers, and such relationships may not continue;

•we may be unable to continue purchasing third-party reinsurance in amounts we desire on commercially acceptable terms or on terms that adequately protect us, and this inability may materially adversely affect our business, financial condition and results of operations;

•our losses and loss expense reserves may be inadequate to cover our actual losses, which could have a material adverse effect on our financial condition, results of operations and cash flows;

•we rely on third-party data, including in our BRATs, and inaccuracies in such data could adversely impact our ability to estimate losses and manage risks;

•unexpected changes in the interpretation of our coverage or provisions, including loss limitations and exclusions, in our policies could have a material adverse effect on our financial condition and results of operations;

•our reinsurers may not reimburse us for claims on a timely basis, or at all, which may materially adversely affect our business, financial condition and results of operation;

•excessive risk taking could negatively affect our financial condition and business;

•adverse economic factors, including recession, inflation, periods of high unemployment or lower economic activity could result in the sale of fewer policies than expected or an increase in the frequency of claims and premium defaults, and even the falsification of claims, or a combination of these effects, which, in turn, could affect our growth and profitability;

•performance of our investment portfolio is subject to a variety of investment risks, including market and credit risks, that may adversely affect our financial results;

•we are subject to extensive regulation, which may adversely affect our ability to achieve our business objectives. In addition, if we fail to comply with these regulations, we may be subject to penalties, including fines, suspensions, revoking licenses, orders to cease and desist operations and criminal prosecution, which may adversely affect our financial condition and results of operations;

•we could be adversely affected by the loss of one or more key personnel or by an inability to attract and retain qualified personnel;

•we could suffer security breaches, loss of data, cyberattacks and other information technology failures and are subject to laws and regulations concerning data privacy and security that are continually evolving;

•we may change our underwriting guidelines or our strategy without stockholder approval;

11

•our costs have increased significantly as a result of operating as a public company, and our management will be required to devote substantial time to complying with public company regulations; and

•although following this offering, we will no longer be a “controlled company” within the meaning of the NYSE rules, we may continue to rely on exemptions from certain corporate governance requirements during a one-year transition period.

Implications of Being an Emerging Growth Company

We qualify as an “emerging growth company” as defined in Section 2(a)(19) of the Securities Act of 1933, as amended (the “Securities Act”). As a result, we are permitted to, and intend to, rely on exemptions from certain disclosure requirements that are applicable to other companies that are not emerging growth companies. Accordingly, in this prospectus, we (i) have presented only two years of audited financial statements and (ii) have not included a compensation discussion and analysis of our executive compensation programs. In addition, for so long as we are an emerging growth company, among other exemptions, we are:

•not required to have our internal control over financial reporting audited by our independent registered public accounting firm pursuant to Section 404(b) of the Sarbanes-Oxley Act;

•permitted to present only two years of audited financial statements and only two years of related “Management’s Discussion and Analysis of Financial Condition and Results of Operations”;

•not required to disclose certain executive compensation related items such as the correlation between executive compensation and performance and comparisons of the chief executive officer’s compensation to median employee compensation; or

•not required to submit certain executive compensation matters to stockholder advisory votes, such as “say-on-pay,” “say-on-frequency” and “say-on-golden parachutes.”

In addition, under the JOBS Act, emerging growth companies can delay adopting new or revised accounting standards until such time as those standards apply to private companies. We have elected to avail ourselves of this extended transition period and, as a result, we are not required to adopt new or revised accounting standards on the relevant dates on which adoption of such standards is required for other public companies.

We will remain an “emerging growth company” until the earliest to occur of:

•the last day of the fiscal year in which we have total annual gross revenues of $1.235 billion or more;

•the date on which we are deemed to be a large accelerated filer under the rules of the SEC, with at least $700.0 million of equity securities held by non-affiliates;

•the date on which we have issued more than $1.0 billion in nonconvertible debt during the previous three years; and

•the last day of our fiscal year following the fifth anniversary of the date of our initial public offering.

Corporate Information

Bowhead Specialty Holdings Inc. was incorporated in Delaware in May 2021. Our principal offices are located at 452 Fifth Avenue, New York, NY 10018. Our telephone number is (212) 970-0269. We maintain a website at www.bowheadspecialty.com. The reference to our website is intended to be an inactive textual reference only. The information contained on, or that can be accessed through, our website is not part of this prospectus.

12

The Offering

Issuer

|

Bowhead Specialty Holdings Inc. |

||||

Common stock offered by the selling stockholders

|

shares (or shares if the underwriters exercise their option to purchase additional shares of common stock in full). |

||||

Option to purchase additional shares of our common stock

|

Certain of the selling stockholders have granted the underwriters the option, for a period of 30 days from the date of this prospectus, to purchase up to additional shares of our common stock at the public offering price less underwriting discounts and commissions. |

||||

Common stock to be outstanding immediately after this offering

|

shares. |

||||

Use of proceeds

|

The selling stockholders will receive all of the net proceeds from this offering. We will not receive any of the proceeds from the sale of common stock offered by the selling stockholders, including any common stock sold pursuant to any exercise by the underwriters of their option to purchase additional shares. See “Use of proceeds.” |

||||

Dividend policy

|

We currently intend to retain any future earnings for use in the operation of our business and do not intend to declare or pay any cash dividends in the foreseeable future. Any determination to declare and pay dividends on our common stock in the future will be at the discretion of our board of directors. Our board of directors may take into account a variety of factors when determining whether to declare any dividends, including (i) our financial condition, results of operations, liquidity and capital requirements, (ii) general business conditions, (iii) legal, tax and regulatory limitations, (iv) contractual prohibitions and other restrictions, (v) the effect of any dividends on our financial strength or other ratings and (vi) any other factors that our board of directors considers relevant.

As a holding company without significant operations of our own, the principal sources of our funds are dividends and other payments from our subsidiaries. The ability of our insurance subsidiaries to pay dividends to us is subject to limits under insurance laws of the state or jurisdiction in which our insurance subsidiary is domiciled. In addition, the consent orders we entered into with the Wisconsin OCI may directly or indirectly affect our ability to declare and pay or the amount of dividends.

|

||||

Loss of Controlled Company Status

|

Prior to the completion of this offering, we have been a “controlled company” within the meaning of Section 303A of the New York Stock Exchange Listed Company Manual, and as a result, have been exempt from certain corporate governance requirements of the NYSE. Following the completion of this offering we will no longer be a “controlled company,” and will therefore be required to comply with all of the applicable corporate governance requirements of the NYSE, within the various transition periods provided by Section 303A. See “Management—Loss of Controlled Company Status.” |

||||

13

Voting

|

Each share of our common stock entitles its holder to one vote on all matters to be voted on by stockholders generally.

We have entered into a board nominee agreement with GPC Fund (the “Board Nominee Agreement”) and an investor matters agreement with AFMIC (the “Investor Matters Agreement”) that grants GPC Fund and AFMIC respectively the right to nominate individuals to our board of directors, provided certain ownership requirements are met. See “Certain Relationships and Related Party Transactions.”

|

||||

Registration Rights Agreement

|

We have entered into a registration rights agreement (the “Registration Rights Agreement”) with AFMIC, GPC Fund and our Chief Executive Officer, which provides customary demand and piggyback registration rights. See “Description of Capital Stock.” |

||||

Risk factors

|

You should read the “Risk Factors” section beginning on page 17 of this prospectus for a discussion of factors you should carefully consider before deciding to invest in shares of our common stock.

|

||||

Trading symbol

|

“BOW” |

||||

The number of shares of common stock that will be outstanding immediately after this offering is based on shares of our common stock outstanding as of , 2024 and excludes:

• shares of common stock reserved for future issuance, including restricted stock unit awards issued under the 2024 Plan;

• shares of common stock reserved for future issuance under the 2024 Plan; and

• shares of common stock reserved for future issuance upon the exercise of the Common Stock Purchase Warrant.

The exercise of the option granted to the underwriters to purchase additional shares of common stock from the selling stockholders will not impact the number of shares of common stock that will be outstanding after this offering.

14

Summary Consolidated Financial and Other Data

Set forth below is our summary consolidated financial and other data as of the dates and for the periods indicated. The summary consolidated statements of income data for the years ended December 31, 2023 and 2022, and the consolidated balance sheet data as of December 31, 2023 and 2022, have been derived from our audited consolidated financial statements included elsewhere in this prospectus. The summary condensed consolidated statements of income data for the six months ended June 30, 2024 and 2023, and the condensed consolidated balance sheet data as of June 30, 2024, have been derived from our unaudited condensed consolidated financial statements included elsewhere in this prospectus. The results of operations for any period are not necessarily indicative of the results to be expected for any future period. You should read the following summary consolidated financial and other data below together with the information under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes thereto included elsewhere in this prospectus.

| Six Months Ended June 30, | Years Ended December 31, |

||||||||||||||||||||||

2024 |

2023 |

2023 | 2022 | ||||||||||||||||||||

($ in thousands) |

|||||||||||||||||||||||

| Consolidated Statements of Income Data: | |||||||||||||||||||||||

| Revenues | |||||||||||||||||||||||

| Gross written premiums | $ | 313,971 | $ | 212,448 | $ | 507,688 | $ | 356,948 | |||||||||||||||

| Ceded written premiums | (111,066) | (72,059) | (173,016) | (111,834) | |||||||||||||||||||

| Net written premiums | 202,905 | 140,389 | 334,672 | 245,114 | |||||||||||||||||||

| Net earned premiums | 173,067 | 117,036 | 263,902 | 182,863 | |||||||||||||||||||

| Net investment income | 16,437 | 7,401 | 19,371 | 4,725 | |||||||||||||||||||

| Net realized investment gains | 2 | — | — | — | |||||||||||||||||||

| Other insurance-related income | 63 | 63 | 125 | 14 | |||||||||||||||||||

| Total revenues | 189,569 | 124,500 | 283,398 | 187,602 | |||||||||||||||||||

| Expenses | |||||||||||||||||||||||

| Net losses and loss adjustment expenses | 113,338 | 70,868 | 166,282 | 111,761 | |||||||||||||||||||

| Net acquisition costs | 14,104 | 9,531 | 20,935 | 15,194 | |||||||||||||||||||

| Operating expenses | 43,377 | 29,080 | 63,456 | 45,986 | |||||||||||||||||||

| Non-operating expenses | 1,698 | — | 630 | — | |||||||||||||||||||

| Warrant expense | 332 | — | — | — | |||||||||||||||||||

| Credit facility interest expenses and fees | 224 | — | — | — | |||||||||||||||||||

| Foreign exchange (gains) losses | 30 | (19) | (20) | — | |||||||||||||||||||

| Total expenses | 173,103 | 109,460 | 251,283 | 172,941 | |||||||||||||||||||

| Income before income taxes | 16,466 | 15,040 | 32,115 | 14,661 | |||||||||||||||||||

| Income tax expense | (3,921) | (3,485) | (7,068) | (3,405) | |||||||||||||||||||

Net income

|

$ | 12,545 | $ | 11,555 | $ | 25,047 | $ | 11,256 | |||||||||||||||

| Key Operating and Financial Metrics: | |||||||||||||||||||||||

Underwriting income(1)

|

$ | 4,981 | $ | 7,557 | $ | 14,035 | $ | 9,922 | |||||||||||||||

Adjusted net income(1)

|

16,068 | 11,540 | 26,152 | 11,256 | |||||||||||||||||||

| Loss ratio | 65.5 | % | 60.6 | % | 63.0 | % | 61.1 | % | |||||||||||||||

| Expense ratio | 33.2 | % | 32.9 | % | 32.0 | % | 33.5 | % | |||||||||||||||

| Combined ratio | 98.7 | % | 93.5 | % | 95.0 | % | 94.6 | % | |||||||||||||||

Return on equity(2)

|

9.4 | % | 22.0 | % | 18.2 | % | 13.1 | % | |||||||||||||||

Adjusted return on equity(1)(2)

|

12.1 | % | 22.0 | % | 19.0 | % | 13.1 | % | |||||||||||||||

| Diluted earnings per share | $ | 0.48 | $ | 0.48 | $ | 1.04 | $ | 0.47 | |||||||||||||||

Diluted adjusted earnings per share(1)

|

$ | 0.62 | $ | 0.48 | $ | 1.09 | $ | 0.47 | |||||||||||||||

15

__________________

(1)Non-GAAP financial measure. See “—Reconciliation of Non-GAAP Financial Measures” for a reconciliation of the non-GAAP financial measure in accordance with the most directly comparable U.S. GAAP measure.

(2)For the six months ended June 30, 2024 and 2023, net income and adjusted net income are annualized to arrive at return on equity and adjusted return on equity.

| As of June 30, | As of December 31, |

||||||||||||||||

| 2024 | 2023 | 2022 | |||||||||||||||

($ in thousands) |

|||||||||||||||||

| Balance Sheet Data: | |||||||||||||||||

| Total investments | $ | 718,911 | $ | 563,448 | $ | 282,923 | |||||||||||

| Cash and cash equivalents | 180,324 | 118,070 | 64,659 | ||||||||||||||

| Restricted cash and cash equivalents | 18,494 | 1,698 | 15,992 | ||||||||||||||

| Premium balances receivable | 69,495 | 38,817 | 29,487 | ||||||||||||||

| Reinsurance recoverable | 192,025 | 139,389 | 63,531 | ||||||||||||||

| Prepaid reinsurance premiums | 133,992 | 116,732 | 74,541 | ||||||||||||||

| Total assets | 1,395,173 | 1,027,859 | 565,207 | ||||||||||||||

| Reserve for losses and loss adjustment expenses | 587,905 | 431,186 | 207,051 | ||||||||||||||

| Unearned premiums | 391,802 | 344,704 | 231,743 | ||||||||||||||

| Reinsurance balances payable | 45,767 | 40,440 | 23,687 | ||||||||||||||

| Total liabilities | 1,055,262 | 835,782 | 481,833 | ||||||||||||||

| Total mezzanine equity and stockholders’ equity | 339,911 | 192,077 | 83,374 | ||||||||||||||

16

RISK FACTORS

Investing in our common stock involves a high degree of risk. You should carefully consider the following information about these risks, together with the other information contained in this prospectus before deciding to invest in shares of our common stock. If any of the following risks actually occur, our business, financial condition or results of operations may be materially adversely affected. In such case, the trading price of our common stock could decline and you may lose all or part of your investment. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations. Some statements in this prospectus, including statements in the following risk factors, constitute forward-looking statements. See “Forward-Looking Statements.”

Risks Related to Our Business and Industry

Our financial condition and results of operations could be materially adversely affected if we do not accurately assess our underwriting risk.